Jeep CEO’s Plan to Tackle Sales Decline

Jeep, a brand known for scaling tough terrains, is facing a steep challenge. After five consecutive years of sales declines in the U.S., the brand saw a 9% decline in the first six months of 2024, with experts predicting a potential sixth year of losses. Jeep CEO Antonio Filosa is optimistic, believing the worst days are behind them. To reach their ambitious target of selling 1 million vehicles domestically by 2027, Filosa is executing a comprehensive turnaround plan aimed at regaining Jeep’s status in the coveted automotive industry.

The turnaround plan includes lowering pricing for high-volume models like the Jeep Compass and Grand Cherokee, along with offering special incentives like 0% financing. Jeep also plans to ramp up marketing efforts and host an upcoming roadshow to address dealer concerns. With a focus on reviving the quintessential American SUV, Filosa is determined to see this strategy pay dividends as the

company navigates its way out of the sales rut.

Jeep CEO Faces Profit Pressures Amid Turnaround

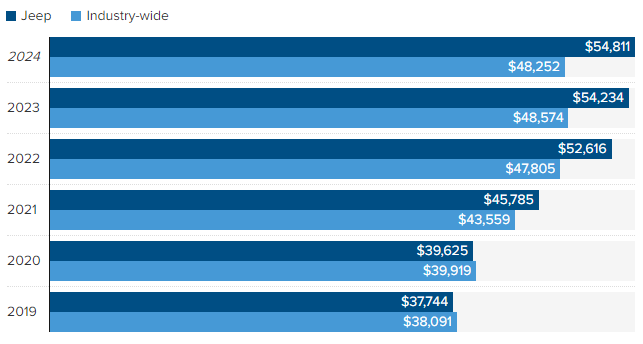

As Jeep CEO Antonio Filosa enacts new strategies to reverse the brand’s sales losses, he must also contend with the challenge of actions that could eat into profits. Since 2020, Jeep’s average transaction prices have skyrocketed, climbing from less than $40,000 to over $50,000 this year, according to Cox Automotive. This puts Jeep’s average price above the industry average since 2021. While higher prices might boost short-term revenues, they could hurt long-term growth if customers turn away from the brand.

dressing U.S. growth concerns. Meanwhile, the chairman of Stellantis National Dealer Council released a scathing letter targeting Stellantis CEO Carlos Tavares for recent business decisions that led to sales declines. Despite Stellantis selling 1.5 million vehicles last year in the U.S., this represented a 1% decline, compared to a 13% industry increase in 2023.

In recent months, Jeep reports a positive shift in sales, with a quarterly U.S. rise of 28% in August 2023 and 55% in July, signaling hope for the brand’s turnaround plan. This increase comes after a challenging period where Jeep sales plummeted by 34% from an all-time high of 973,000 SUVs in 2018 to less than 643,000 units last year.

Despite the brand’s efforts to regain market traction, lowered vehicle inventory—aroun

d 25,000 units at the time—had a significant impact. While other auto brands increased their sales by 6%, Jeep’s ongoing recovery is a crucial focus for returning to past success.

Jeep’s Annual Average Transaction Price in the U.S. Compared to the Overall Industry

Jeep has faced recent declines in sales, leading to the ending of production for some models. Last year, the company halted production of the entry-level Renegade and Cherokee, as well as the compact SUV, which were once mainstream models peaking at 300,000 units annually between 2016 and 2019. This has significantly impacted Jeep’s market coverage, with Cherokee and Renegade being crucial to their lineup.

Filosa has acknowledged that Jeep needs to quickly recover its market share, which has declined from

an average of 80% to 45%. To address this, the company plans to introduce an unnamed replacement for the Cherokee and new electrified models by the end of next year. These efforts are crucial for Jeep to regain its 80% market share in key segments where it competes.

Looking forward, Stellantis is steering its brands, including Jeep, towards a more profitable future. Stellantis CEO Carlos Tavares has emphasized a cost-cutting mission and focused on increasing profits and market share as part of the company’s Dare Forward 2030 plan. This initiative, stemming from the merger of Fiat Chrysler and France’s PSA Groupe in January 2021, aims to double revenue to 300 billion euros (about $325 billion) by 2030.

Jeep is targeting 1.5 million SUVs globally by 2027, with 1 million of those in the U.S. to meet its ambitious goals. Tavares has pushed for leniency in pricing and incentives to achieve these financial targets. To support these efforts, Filosa will engage in a dealer roadshow next month, with North American head Bob Broderdorf joining in. This initiative is part of a broader strategy to meet dealers’ concerns and drive the brand’s turnaround efforts

To boost its sales, Jeep has increased its media spending by 20% in the first half of the year. This push is part of a broader strategy to accelerate sales and recover from recent declines. With these new products and enhanced marketing efforts, Filosa aims to shift the narrative to a completely different story, driving growth and revitalizing the brand’s market presence.